Chapter 13 Attorney in West Monroe, LA

Request Free Consultation

Understanding Chapter 13 Bankruptcy

Chapter 13 bankruptcy, often referred to as reorganization bankruptcy or a wage earner's plan, offers individuals with regular income a path to financial recovery. Sam Henry IV Attorney At Law specializes in guiding clients through this complex process. Chapter 13 allows you to create a structured repayment plan, typically spanning three to five years, to address your debts while retaining your assets. This approach can help you catch up on missed payments and prevent foreclosure or repossession. Additionally, debtors are allowed to keep their assets and repay their debts through this approved plan.

If you're facing financial difficulties, our firm in West Monroe, LA is here to provide compassionate, personalized assistance. Request a FREE consultation with Sam Henry today.

Recognizing the Need for Chapter 13 Bankruptcy

Determining whether Chapter 13 is the right solution for your financial situation can be challenging. Sam Henry IV Attorney At Law can help you assess your options. Here are some signs that Chapter 13 might be appropriate for you:

- Falling behind on mortgage or car loan payments

- Facing potential foreclosure or repossession

- Having a steady income but struggling with debt

- Desiring to keep your assets while addressing financial obligations

- Needing a structured plan to repay debts over time

- Seeking protection from creditor harassment

If you recognize these signs in your financial situation, it may be time to explore Chapter 13 bankruptcy. Contact Sam Henry for a FREE consultation to discuss your options. Virtual consultations are available for your convenience.

Benefits of Choosing Chapter 13 Over Other Bankruptcy Options

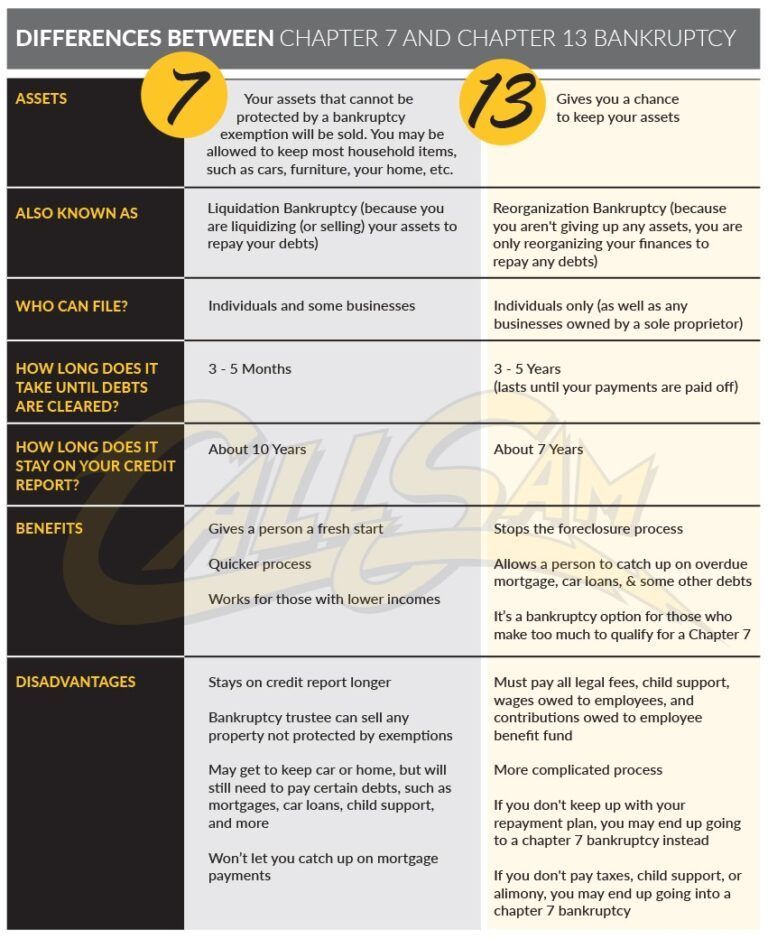

Unlike Chapter 7, which may involve liquidating assets, Chapter 13 lets you keep your property and create a repayment structure that fits your income. This can be particularly beneficial for people with significant secured debt, such as mortgages or car loans. Chapter 13 also offers the advantage of catching up on past-due payments while protecting co-signers from creditor actions.

By working with a Chapter 13 Attorney in West Monroe, LA, you gain legal support that helps prevent common filing mistakes and ensures you meet all requirements. This guidance can mean the difference between a plan that works for you and one that creates further strain.

Importance of Chapter 13 Bankruptcy Protection

Chapter 13 bankruptcy can provide crucial financial relief and protection for individuals facing overwhelming debt. Here's why you might need to consider this option:

- Ability to create a manageable repayment plan

- Protection of your assets from seizure

- Opportunity to catch up on missed payments

- Prevention of foreclosure or repossession

- Consolidation of debts into a single payment

- Potential for partial debt forgiveness

Sam Henry IV Attorney At Law understands the complexities of Chapter 13 bankruptcy and can help you navigate this process effectively. Reach out to explore how we can assist you in regaining financial stability. Stop the harassment and keep your belongings!

Choose Sam Henry IV Attorney At Law

When facing financial challenges, having the right Chapter 13 attorney in West Monroe, LA is crucial. Sam Henry IV Attorney At Law offers numerous benefits to his clients:

- FREE initial consultations

- Over 35 years of legal experience

- Personalized, one-on-one approach

- Compassionate and effective representation

- Same-day appointments available

- Competitive filing fees

- Member of the Louisiana State Bar Association

Our firm is dedicated to providing you with the support and guidance you need during this challenging time. Let Sam Henry help you take the first step towards financial recovery. Request a FREE consultation today to get started.

Preparing to File for Chapter 13

Before filing, it’s important to gather financial records, including pay stubs, tax returns, mortgage statements, and details about outstanding debts. This documentation allows the court to evaluate your repayment ability and approve a plan that fits your situation.

Many clients are surprised at how much relief they feel simply by meeting with Sam Henry IV Attorney At Law to review their financial picture. A Chapter 13 Attorney in West Monroe, LA can help you prepare the documents correctly and avoid delays in the process.

How Creditors Are Affected By Chapter 13

Creditors are bound by the terms of your repayment plan once it is approved. This means they must accept the payments outlined by the court rather than pursuing further action against you. While this may not eliminate every debt, it provides order and protection that many individuals desperately need.

Working with a Chapter 13 Attorney in West Monroe, LA makes certain that your creditors comply with the legal process. This ensures that you can focus on meeting your repayment obligations without additional stress.

How Chapter 13 Bankruptcy Works in Practice

When filing for Chapter 13, the court approves a repayment plan that generally lasts three to five years. During this time, creditors are prohibited from continuing collection actions.

The Emotional Relief of Chapter 13 Protection

Financial strain doesn’t just affect your bank account—it impacts your health, relationships, and overall quality of life. Many individuals feel constant stress due to creditor harassment and the fear of losing their home or vehicle.

By working with Sam Henry IV Attorney At Law, you gain more than legal support—you gain peace of mind. A Chapter 13 Attorney in West Monroe, LA can help you stop the cycle of worry and start building toward a brighter future.

Common Situations That Lead to

Chapter 13 Bankruptcy

People turn to Chapter 13 for many reasons, including sudden job changes, medical bills, and unexpected emergencies. Others simply find themselves struggling with the weight of long-term debt. In these cases, a structured repayment plan can bring much-needed stability.

With an experienced Chapter 13 Attorney in West Monroe, LA, you can take steps toward protecting your assets, reducing creditor pressure, and creating a sustainable financial strategy.

Key Features of a Chapter 13 Repayment Plan

Every plan is tailored to the filer’s income and obligations, but most include:

- Consolidated payments: A single monthly payment instead of juggling multiple bills.

- Reduced stress: Protection from creditor calls and collection actions.

- Asset protection: Ability to keep homes, cars, and personal property.

- Time to recover: A repayment term of three to five years allows you to get back on track.

- Court approval: Oversight that ensures your plan is legally sound and enforceable.

Sam Henry IV Attorney At Law understands how overwhelming the process can feel. Having a Chapter 13 Attorney in West Monroe, LA by your side can give you the confidence to move forward.

What to Expect After Filing Chapter 13

Once your repayment plan is approved, you’ll begin making consistent payments to a trustee. Over time, you’ll see your debt reduced and your financial outlook improve. If you complete the plan successfully, you may even receive a discharge of certain remaining debts.

This long-term solution can help you restore credit, protect valuable property, and create better financial habits. A Chapter 13 Attorney in West Monroe, LA will remain available throughout the repayment period to address questions or concerns.

Take Action Towards Financial Freedom

Don't let financial stress overwhelm you any longer. Sam Henry IV Attorney At Law is here to help you navigate the Chapter 13 bankruptcy process and work towards a brighter financial future.

With his extensive experience and compassionate approach, you'll get the effective representation you need. Contact us today to schedule your FREE consultation and learn how Sam Henry can assist you in regaining control of your finances.

Share On: