Bankruptcy Lawyer in West Monroe, LA

Request Free Consultation

Filing For Bankruptcy: A Path To Financial Relief

When debt becomes unmanageable, many people feel trapped and unsure of where to turn. Filing for bankruptcy can provide a structured, legal pathway to financial recovery. It not only stops creditor harassment but also lays the groundwork for a fresh start.

Working with a bankruptcy lawyer in West Monroe, LA gives you the clarity and confidence needed to understand the process and choose the right path. With knowledgeable representation, filing becomes less overwhelming and more of an opportunity to rebuild.

Determining If Bankruptcy is the Right Choice

Not every financial challenge requires bankruptcy, but for many individuals and families, it is the most effective solution. Understanding whether you qualify and what benefits you may receive is critical before moving forward.

Situations Where Bankruptcy May Be Appropriate

- Facing lawsuits, wage garnishments, or repossession.

- Struggling to pay even minimum balances on debts.

- Falling behind on mortgage or car payments.

- Using credit cards to cover daily expenses.

- Dealing with overwhelming medical debt.

Consulting a bankruptcy lawyer ensures that your financial situation is evaluated carefully so you can make an informed decision.

Expert Bankruptcy Lawyer in West Monroe, LA Offering Tailored Solutions to Conquering Debt

Sam Henry IV Attorney At Law offers honest advice and effective solutions for your financial well-being, without resorting to high-pressure sales tactics. With decades of experience in bankruptcy law, Sam Henry can help you explore all available options, stop creditor harassment, retain your assets, and guide you toward a more stable financial future.

Navigating bankruptcy can seem daunting. Sam Henry IV Attorney At Law is a bankruptcy lawyer in West Monroe, LA that's here to help you navigate the intricacies of the process.

Understanding Bankruptcy

Bankruptcy is a legal process that individuals can initiate when they are unable to pay their debts. It provides a structured way to address overwhelming financial obligations and offers debtors a fresh start.

Types of Bankruptcy Filings

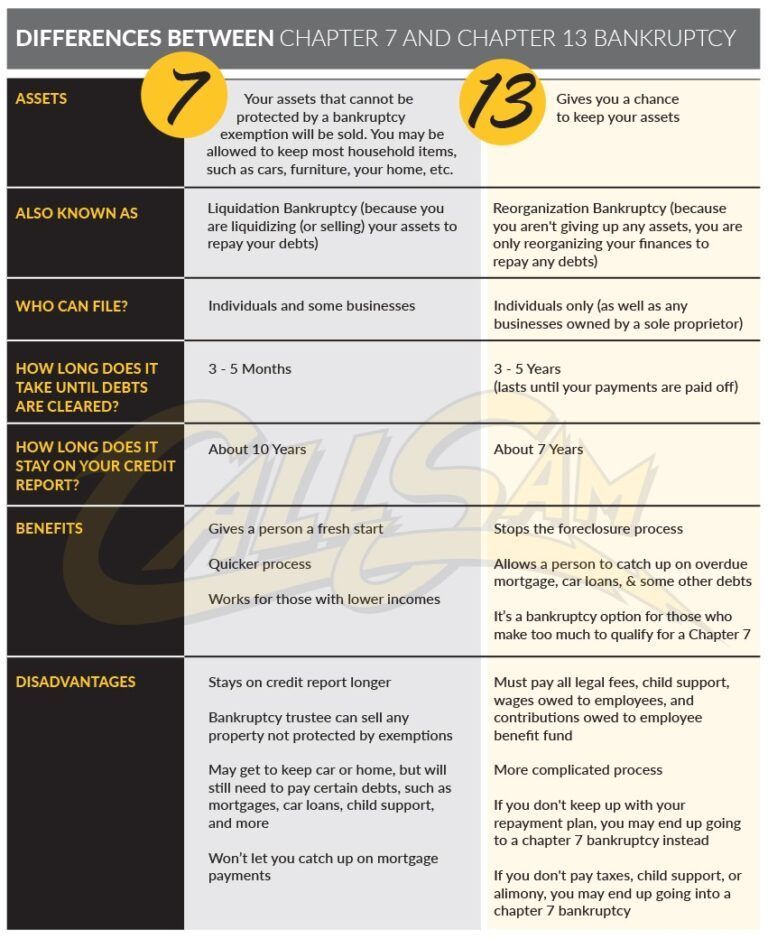

While Chapter 7 and Chapter 13 are the most common, each serves a different purpose. Choosing the right type depends on your income, assets, and long-term goals.

Chapter 7 Bankruptcy: Liquidation Bankruptcy

Chapter 7 bankruptcy is a liquidation bankruptcy, meaning that the debtor's nonexempt assets are sold to pay creditors. To qualify for Chapter 7, debtors must meet certain income and debt requirements. If they qualify, they can discharge most of their unsecured debts, such as credit card balances and medical bills.

Chapter 7 allows eligible individuals to discharge unsecured debts, often in just a few months. While certain assets may be sold to pay creditors, many essentials are protected through exemptions.

Chapter 13 Bankruptcy: Reorganization Bankruptcy

Chapter 13 bankruptcy is a reorganization bankruptcy, meaning that the debtor proposes a plan to repay creditors over a period of time. Chapter 13 can be an option for debtors who have more assets or income than Chapter 7 allows, or who want to keep their property but cannot afford to pay their debts in full.

Chapter 13 provides a repayment plan that spans three to five years. This option works best for people with steady income who want to keep their property while catching up on overdue payments.

A bankruptcy lawyer in West Monroe, LA will help determine which filing best fits your situation and protects your interests.

Myths And Misunderstandings About Bankruptcy

Unfortunately, myths prevent many people from seeking help when bankruptcy could be life-changing.

Common Misconceptions

- Myth: Bankruptcy means losing everything.

- Reality: Many assets are exempt under Louisiana law.

- Myth: Bankruptcy permanently ruins credit.

- Reality: Many filers see improved credit within a couple of years.

- Myth: Filing is only for people who mismanage money.

- Reality: Job loss, medical bills, or unexpected expenses are the most common causes.

Clarifying these points with a bankruptcy lawyer in West Monroe, LA helps you see the real potential of filing.

Benefits of Filing for Bankruptcy

Many people hesitate to file because of fear or misconceptions. However, bankruptcy offers powerful benefits that can improve both your financial and personal life.

Key Benefits

- Stops creditor harassment and collection calls.

- Halts foreclosure, repossession, and wage garnishment.

- Discharges or reorganizes overwhelming debts.

- Provides a clear plan toward financial recovery.

- Offers peace of mind by removing financial uncertainty.

By working with a bankruptcy lawyer in West Monroe, LA, you can maximize these benefits and avoid costly mistakes.

Life After Bankruptcy

One of the most important aspects to understand is that bankruptcy is not the end — it is a beginning. Many clients find themselves better prepared to handle finances after going through the process.

Steps to Rebuild Credit

- Open a secured credit card and use it responsibly.

- Pay all bills on time to show consistency.

- Keep debt balances low relative to available credit.

- Save money regularly to build financial security.

With support from a bankruptcy lawyer, you can transition smoothly from filing to financial recovery.

Local Experience Makes a Difference

Bankruptcy is a federal process, but local courts and trustees often have unique procedures. Choosing a bankruptcy lawyer in West Monroe, LA ensures that your case is handled with familiarity and efficiency. Local representation also means easier communication and a better understanding of the challenges faced by people in this community.

Preparing for Your First Consultation

Before meeting with an attorney, gathering financial documents can make your consultation more productive.

Items to Bring

- Recent pay stubs or income statements.

- Tax returns from the past two years.

- Bank account records.

- Mortgage, car loan, and lease agreements.

- A detailed list of debts and creditors.

Having this information ready allows a bankruptcy lawyer in West Monroe, LA to provide accurate advice right away.

Why Legal Guidance is Essential

Attempting to file on your own can lead to errors, missed deadlines, or even dismissal of your case. Having professional representation protects your rights and improves your chances of success.

Advantages of Professional Representation

- Accurate preparation and filing of documents.

- Guidance on exemptions to protect assets.

- Representation at hearings and trustee meetings.

- Strategic advice for rebuilding after discharge.

These benefits highlight why many people choose to work with a bankruptcy lawyer in West Monroe, LA rather than filing on their own.

Step-By-Step Overview

- Initial consultation and financial review.

- Completion of a required credit counseling course.

- Filing the petition with the bankruptcy court.

- Implementation of the automatic stay, stopping collections.

- Trustee review and the 341 meeting of creditors.

- Execution of repayment or discharge process.

- Final discharge order, closing the case.

One of our bankruptcy lawyers can walk you through each stage, ensuring compliance with local court rules and deadlines.

Contact Us

Our bankruptcy lawyer in West Monroe, LA can help you navigate the complex bankruptcy process and determine which chapter is right for you. When choosing a bankruptcy attorney, it is important to have someone compassionate and understanding of the financial challenges you are facing.

Sam Henry IV Attorney At Law is here to provide you with effective solutions for your debt and strive toward the same goal of financial independence. Contact us today to get started.

Share On: